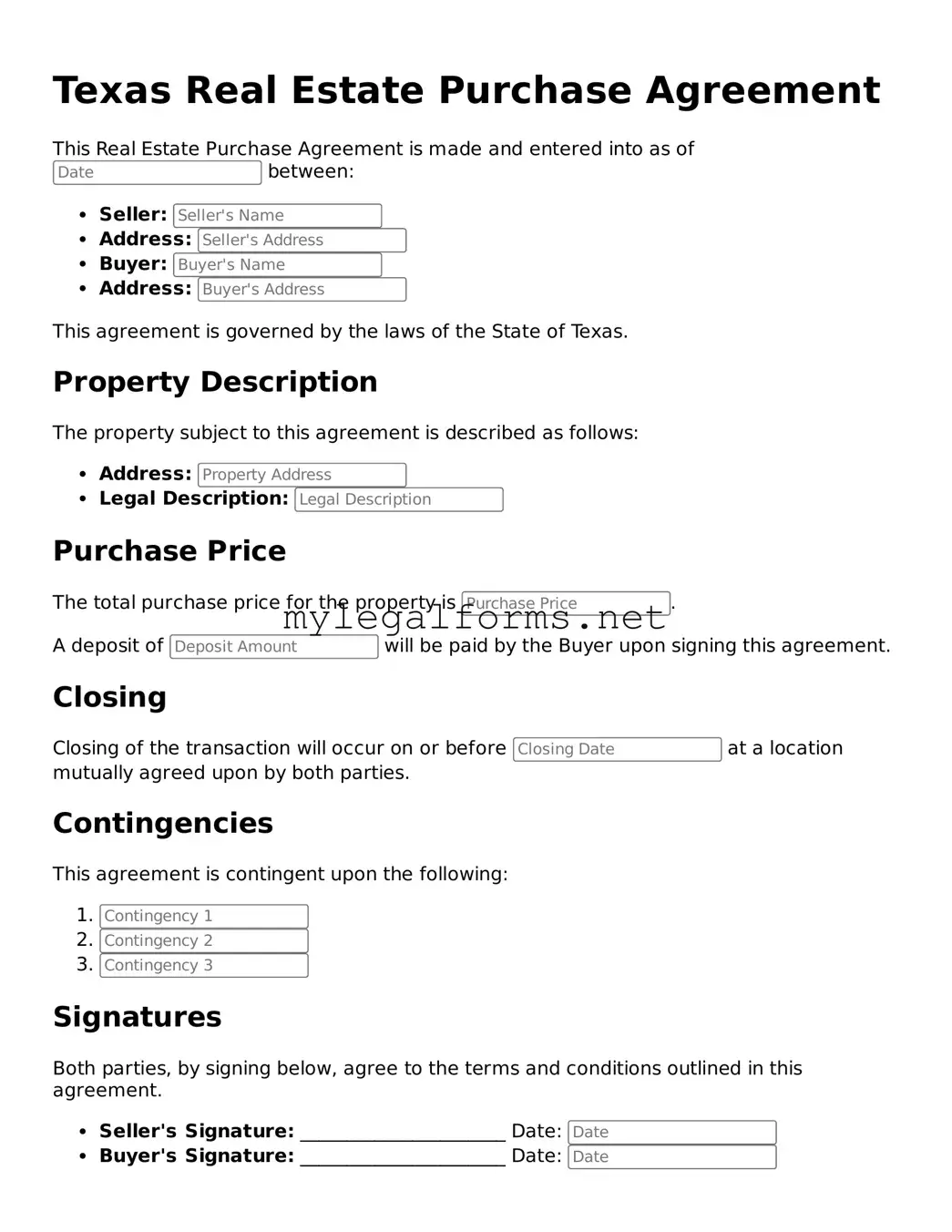

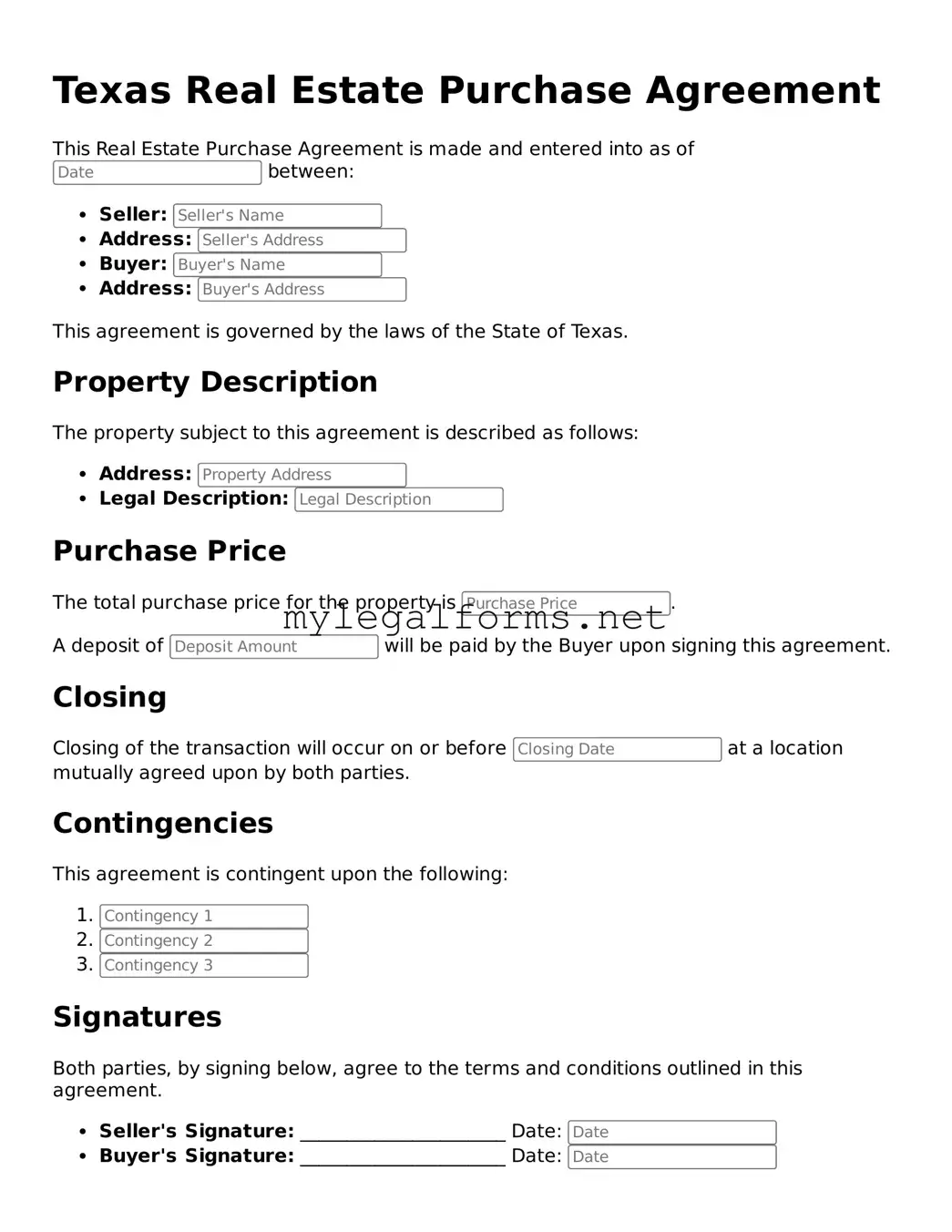

Real Estate Purchase Agreement Document for Texas State

The Texas Real Estate Purchase Agreement is a legal document that outlines the terms and conditions for buying and selling property in Texas. This form serves as a crucial tool for both buyers and sellers, ensuring that all parties understand their rights and obligations. Understanding this agreement can help facilitate a smoother transaction process.

Launch Real Estate Purchase Agreement Editor

Real Estate Purchase Agreement Document for Texas State

Launch Real Estate Purchase Agreement Editor

Launch Real Estate Purchase Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Real Estate Purchase Agreement online and download the final version.