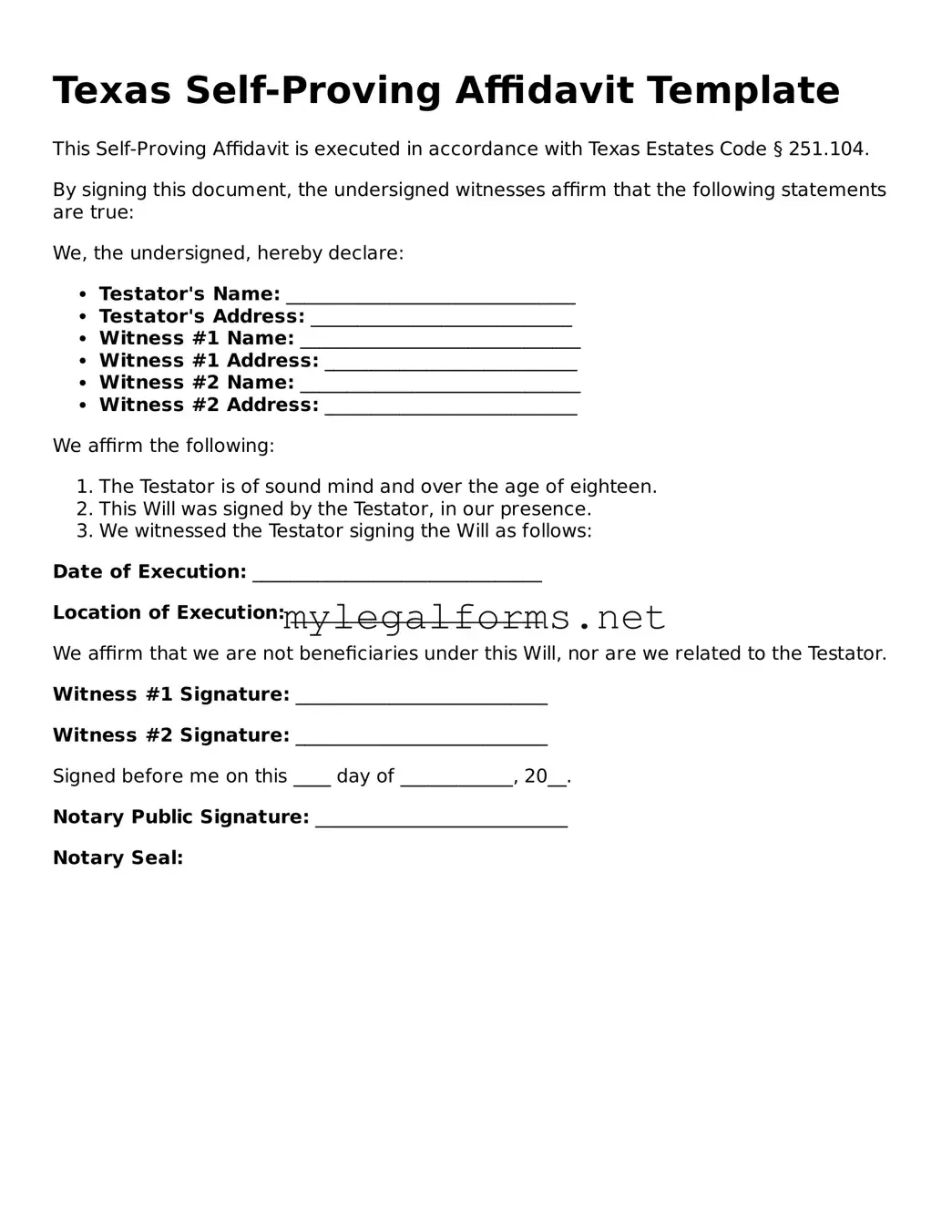

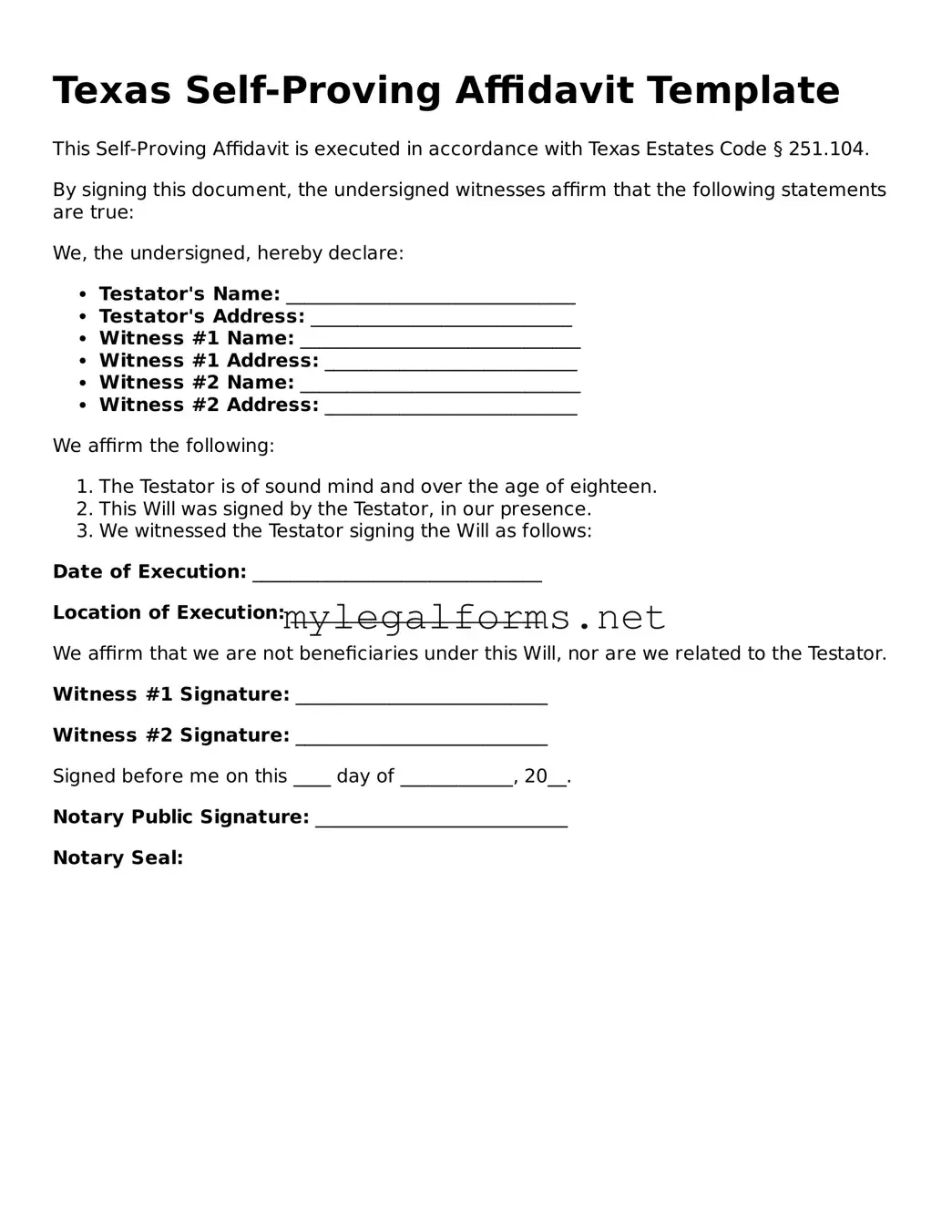

Self-Proving Affidavit Document for Texas State

The Texas Self-Proving Affidavit is a legal document that allows a testator's will to be validated without the need for witnesses to testify in court. This form streamlines the probate process, providing a more efficient way to establish the authenticity of a will. Understanding its importance can significantly impact the administration of an estate in Texas.

Launch Self-Proving Affidavit Editor

Self-Proving Affidavit Document for Texas State

Launch Self-Proving Affidavit Editor

Launch Self-Proving Affidavit Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Self-Proving Affidavit online and download the final version.