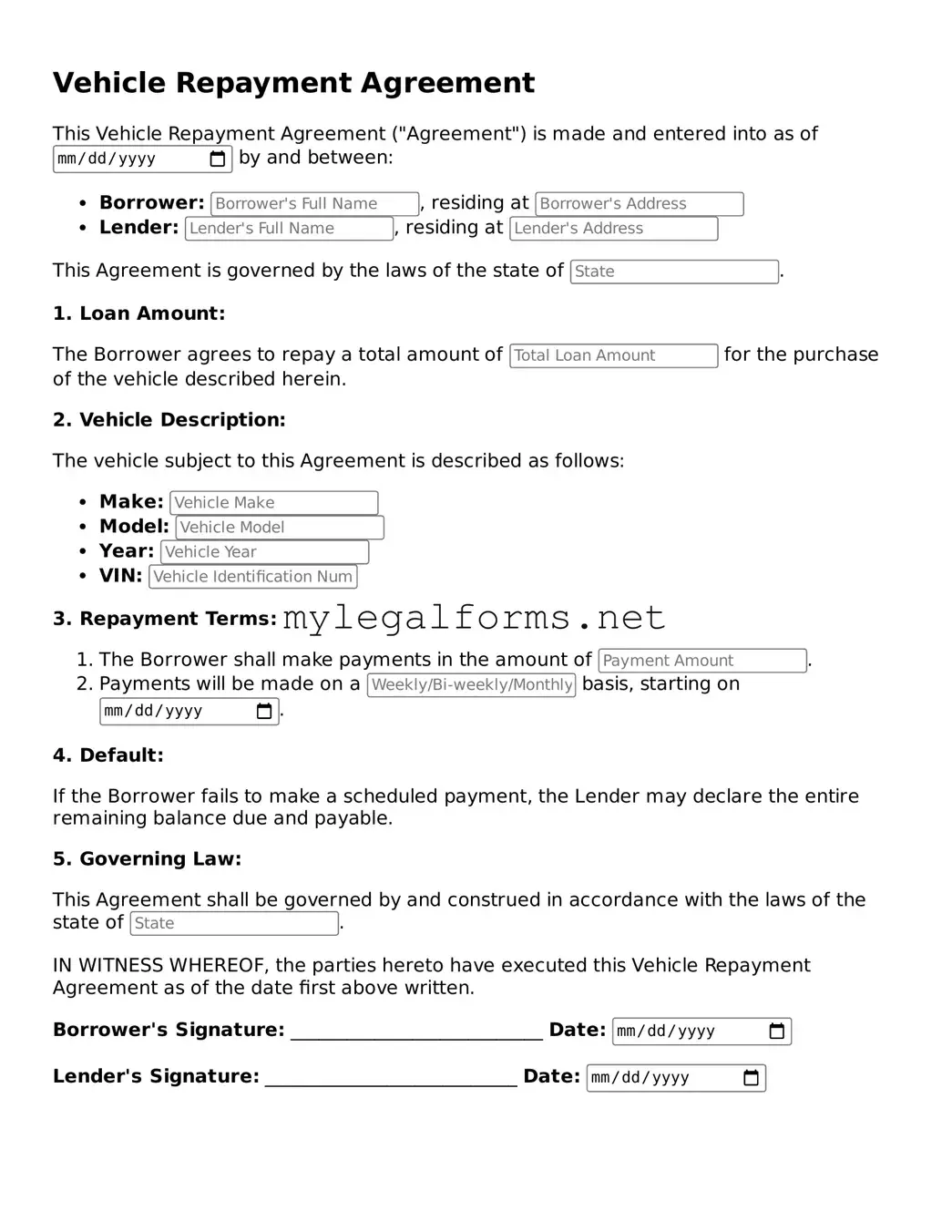

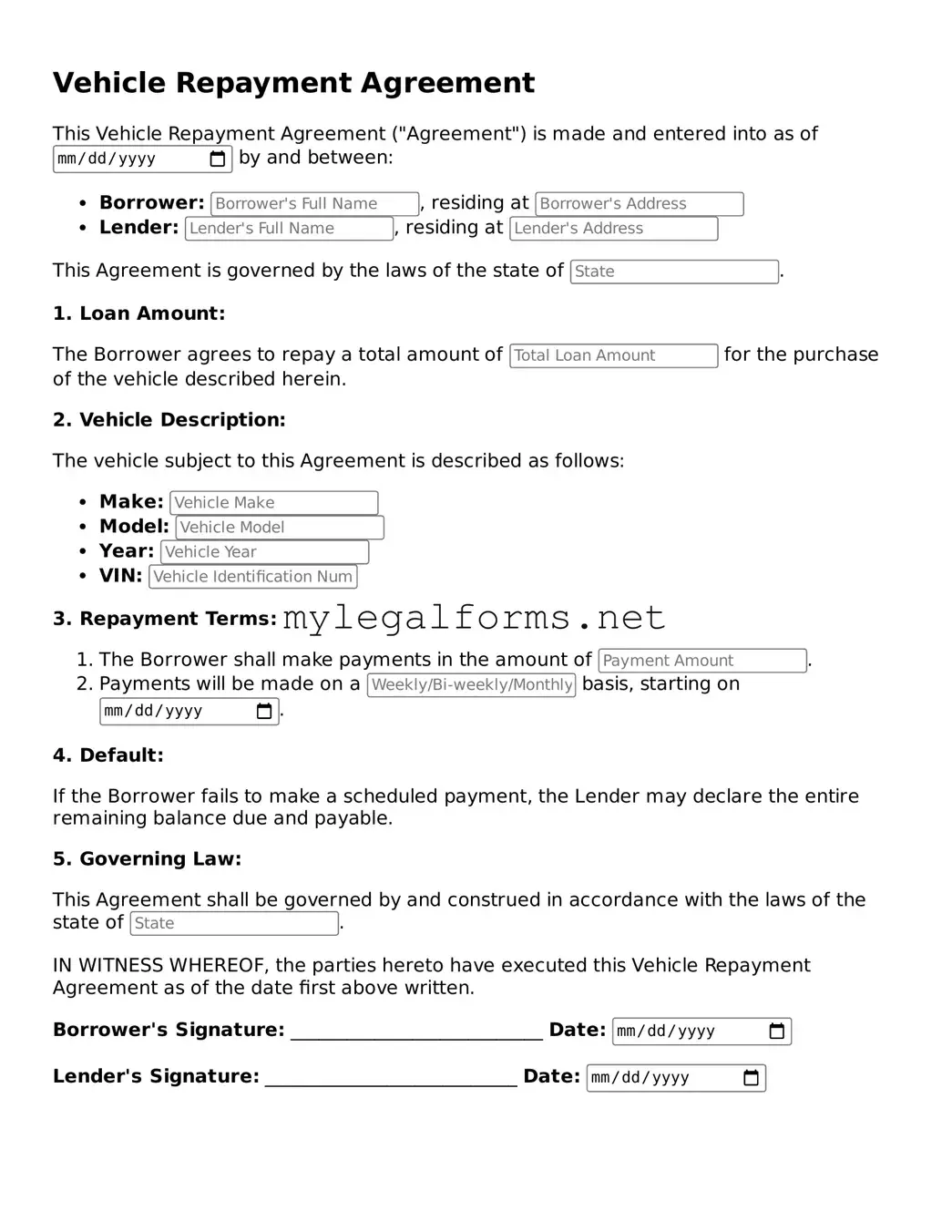

Attorney-Approved Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. This agreement details the payment schedule, interest rates, and consequences of defaulting on the loan. Understanding this form is crucial for both lenders and borrowers to ensure a clear and fair repayment process.

Launch Vehicle Repayment Agreement Editor

Attorney-Approved Vehicle Repayment Agreement Form

Launch Vehicle Repayment Agreement Editor

Launch Vehicle Repayment Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Vehicle Repayment Agreement online and download the final version.