The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form is essential for ensuring that all income is accurately reported to the...

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for corporations to comply with federal tax obligations and to determine...

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect to be taxed as an S Corporation. This election can lead to significant tax benefits, including the avoidance of double taxation on corporate income. Understanding...

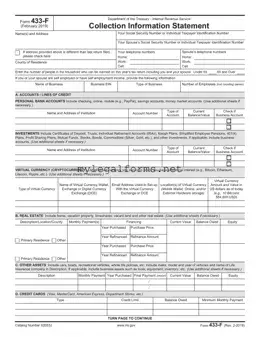

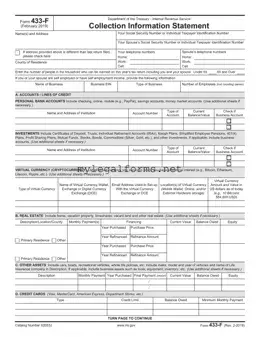

The IRS 433-F form is a financial statement used by individuals and businesses to provide the Internal Revenue Service with a detailed overview of their financial situation. This form is often required during the process of negotiating a payment plan...

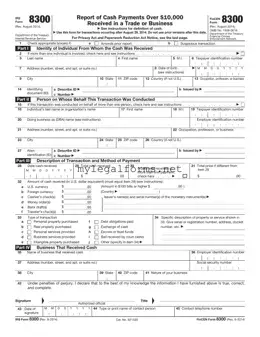

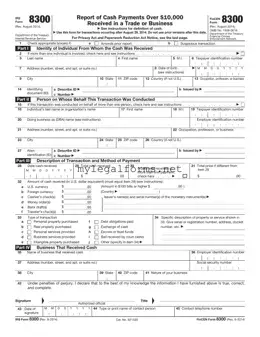

The IRS Form 8300 is a document used to report cash payments over $10,000 received in a trade or business. This form helps the Internal Revenue Service track large cash transactions to prevent money laundering and tax evasion. Understanding its...

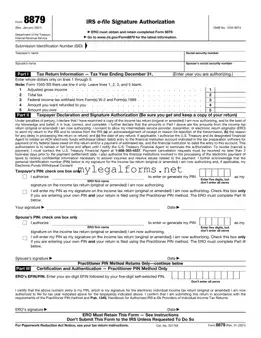

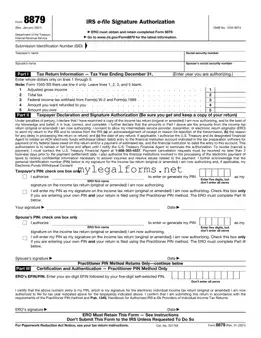

The IRS 8879 form, also known as the "IRS e-file Signature Authorization," serves as a crucial document for taxpayers who wish to e-file their federal tax returns. This form allows taxpayers to authorize their tax preparers to submit their returns...

The IRS 940 form is a crucial document used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes. This form helps the Internal Revenue Service track unemployment tax contributions, ensuring compliance with federal regulations. Understanding how to complete...

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax obligations. Understanding...

The IRS Schedule B 941 form is used by employers to report their federal payroll tax liabilities. This form provides detailed information about the amount of taxes withheld from employees' paychecks and the employer's share of Social Security and Medicare...

The IRS Schedule C 1040 form is a crucial document for sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings and expenses, ultimately determining their taxable income. Understanding how to...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form allows individuals to detail their business expenses and calculate their net profit or loss. Understanding how...

The IRS W-2 form is a crucial document that reports an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this form to their employees by the end of January each year, ensuring that individuals have...